Harami Candlestick Reversal Pattern . In this article, we will look at what the harami candlestick is and how you can use it in day trading. Technical traders respect the indications. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. It is generally indicated by a. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. the harami candlestick pattern is frequently used in forex trading to identify trend reversals or extensions. a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. Sometimes it signals the start of a trend reversal. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity.

from forextraininggroup.com

The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity. It is generally indicated by a. a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. In this article, we will look at what the harami candlestick is and how you can use it in day trading. Technical traders respect the indications. Sometimes it signals the start of a trend reversal. the harami candlestick pattern is frequently used in forex trading to identify trend reversals or extensions. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals.

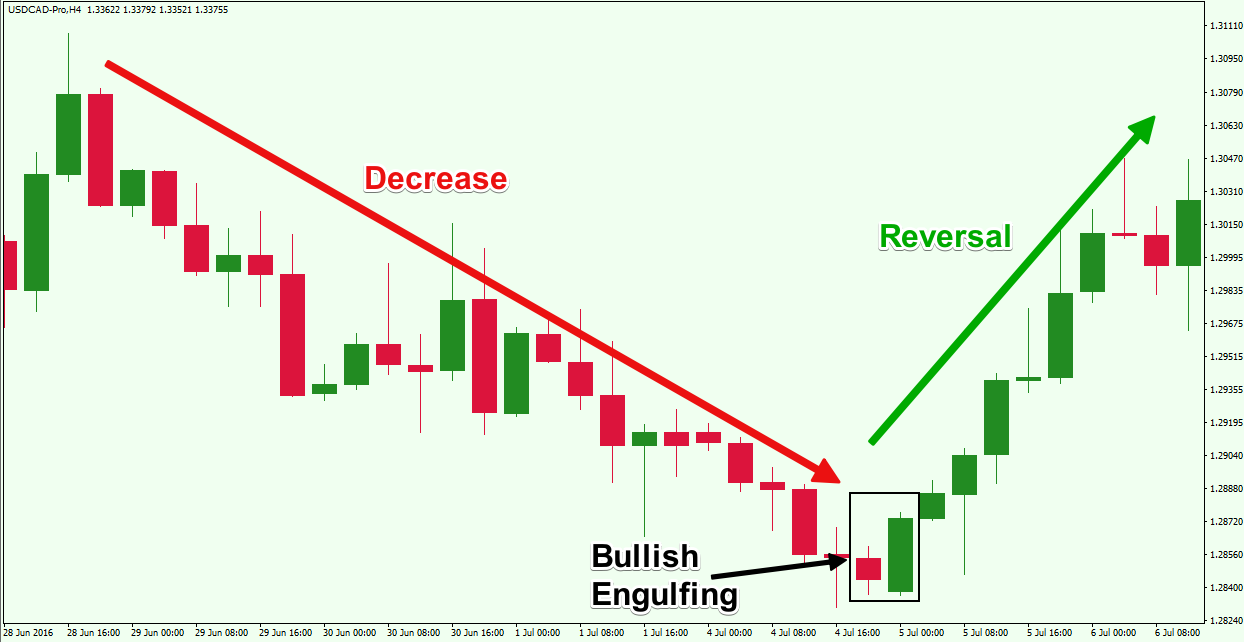

Top Forex Reversal Patterns that Every Trader Should Know Forex

Harami Candlestick Reversal Pattern Sometimes it signals the start of a trend reversal. a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals. It is generally indicated by a. Technical traders respect the indications. Sometimes it signals the start of a trend reversal. the harami candlestick pattern is frequently used in forex trading to identify trend reversals or extensions. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity. In this article, we will look at what the harami candlestick is and how you can use it in day trading.

From www.dailyfx.com

Harami Candlestick Patterns A Trader’s Guide Harami Candlestick Reversal Pattern the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. among them, the harami candlestick is a relatively popular pattern that traders use to. Harami Candlestick Reversal Pattern.

From nifty50view.blogspot.com

to Nifty50 Striker Zone...!!! Bearish Harami Reversal Harami Candlestick Reversal Pattern The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a. Harami Candlestick Reversal Pattern.

From forextraininggroup.com

Top Forex Reversal Patterns that Every Trader Should Know Forex Harami Candlestick Reversal Pattern a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity.. Harami Candlestick Reversal Pattern.

From www.fx141.com

Reversal Candlestick Patterns Guida PDF Harami Candlestick Reversal Pattern In this article, we will look at what the harami candlestick is and how you can use it in day trading. a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. It is generally indicated by a. a bullish harami is a candlestick chart indicator used for spotting reversals in a. Harami Candlestick Reversal Pattern.

From www.daytradetheworld.com

Harami Candlestick Pattern Definition and Strategies DTTW™ Harami Candlestick Reversal Pattern Sometimes it signals the start of a trend reversal. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. a harami cross is a candlestick pattern that consists of a large. Harami Candlestick Reversal Pattern.

From srading.com

Top Reversal Candlestick Patterns Harami Candlestick Reversal Pattern the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. a bullish harami is a candlestick chart indicator used for spotting reversals in a. Harami Candlestick Reversal Pattern.

From www.forextrading200.com

bearish harami reversal candlestick pattern Forex Trading Forex Harami Candlestick Reversal Pattern The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity. the harami candlestick pattern is frequently used in forex trading to identify trend reversals. Harami Candlestick Reversal Pattern.

From www.youtube.com

Candlestick Reversal Signals YouTube Harami Candlestick Reversal Pattern In this article, we will look at what the harami candlestick is and how you can use it in day trading. Sometimes it signals the start of a trend reversal. a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. a bullish harami is a candlestick chart indicator used for spotting. Harami Candlestick Reversal Pattern.

From traderrr.com

The Bearish Harami candlestick pattern show a strong reversal Harami Candlestick Reversal Pattern a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. It is generally indicated by a. Sometimes it signals the start of a trend reversal. Technical traders respect the indications. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. the. Harami Candlestick Reversal Pattern.

From nifty50view.blogspot.com

to Nifty50 Striker Zone...!!! Bearish Harami Reversal Harami Candlestick Reversal Pattern the harami candlestick pattern is frequently used in forex trading to identify trend reversals or extensions. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals. Sometimes it signals the start of a trend reversal. In this article, we will look at what the harami candlestick is and how you can. Harami Candlestick Reversal Pattern.

From theforexgeek.com

Harami Candlestick Pattern The Forex Geek Harami Candlestick Reversal Pattern The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity. a bullish harami is a candlestick chart indicator used for spotting reversals in a. Harami Candlestick Reversal Pattern.

From www.dailyfx.com

Harami Candlestick Patterns A Trader’s Guide Harami Candlestick Reversal Pattern a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. Sometimes it signals the start of a trend reversal. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. Technical traders respect the indications. the harami candlestick pattern is frequently used in forex trading. Harami Candlestick Reversal Pattern.

From srading.com

Top Reversal Candlestick Patterns Harami Candlestick Reversal Pattern It is generally indicated by a. Technical traders respect the indications. Sometimes it signals the start of a trend reversal. a harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. the bullish harami candlestick. Harami Candlestick Reversal Pattern.

From www.vrogue.co

Harami Candlestick Chart Reversals Candlestick Chart vrogue.co Harami Candlestick Reversal Pattern It is generally indicated by a. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. the harami candlestick pattern is frequently used in forex trading to identify trend reversals or extensions. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end.. Harami Candlestick Reversal Pattern.

From www.tradingview.com

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO Harami Candlestick Reversal Pattern Technical traders respect the indications. the harami candlestick pattern is frequently used in forex trading to identify trend reversals or extensions. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals. Sometimes it signals the start of a trend reversal. a harami cross is a candlestick pattern that consists of. Harami Candlestick Reversal Pattern.

From www.learnstockmarket.in

Bullish Harami Candle Stick Pattern Harami Candlestick Reversal Pattern The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end. It is generally indicated by a. Sometimes it signals the start of a trend reversal. the bullish harami candlestick formation is a trend reversal pattern that occurs at the end of a downward trend and signals a buying opportunity.. Harami Candlestick Reversal Pattern.

From learn.bybit.com

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals Harami Candlestick Reversal Pattern In this article, we will look at what the harami candlestick is and how you can use it in day trading. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. among them, the harami candlestick is a relatively popular pattern that traders use to identify chart reversals. Technical traders respect the. Harami Candlestick Reversal Pattern.

From www.alamy.com

Harami Cross Pattern Bearish Green & Red Round Bearish Reversal Harami Candlestick Reversal Pattern In this article, we will look at what the harami candlestick is and how you can use it in day trading. Sometimes it signals the start of a trend reversal. a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. a harami cross is a candlestick pattern that consists of a large. Harami Candlestick Reversal Pattern.